November 22, 2017

What does a CRA Notice of Assessment Mean? How can you get it? What does it look like? Here is everything you need to know about CRA Notice of Assessments.

What Does a CRA Notice of Assessment Mean?

When you submit your income taxes, the Canada Revenue Agency (CRA) conducts its initial review of your return. When this is done, it sends out a Notice of Assessment (NOA). This CRA Assessment shows whether the agency believes you owe a balance, owe nothing, or are scheduled to receive a refund.

The Notice of Assessment may match what you listed on your taxes. For instance, when you complete your return, you will list information on your income, your relevant expenses, your donations, etc. The CRA will review this information and, if the agency believes your numbers are accurate, it will send an assessment that matches your numbers. If you paid your taxes when you filed, the CRA assessment will show a zero balance. If you did not pay when you filed, it will show a balance owing. You may also receive a refund, depending on your situation.

In these cases, where the numbers listed by the CRA are the same as the numbers you entered on your return, there likely isn’t much for you to do at this point. However, the agency may determine that the numbers you entered on your tax return should be different. For example, the agency may not consider certain donations to be valid and, if this happens, it will send a Notice of Assessment that is different from the return you submitted.

If this happens, you may have a balance owing that you didn’t expect. If you agree with the CRA’s interpretation of your tax situation, you can pay this balance and move on. If the amount is larger than you can afford to pay in one payment, you may need to contact the agency and arrange a payment plan.

The CRA may accept payments monthly rather than a lump sum, but it is often only willing to accept payment terms in certain situations. You may be asked to show that you made attempts to pay the amount owing by adjusting your budget and cutting costs as well before the agency will agree to payment terms. Working with an experienced professional can increase the chances of these CRA negotiations being successful. We have extensive experience in communicating and negotiating with the CRA and have resolved tax problems for taxpayers in many different situations. Whenever you need to provide the CRA with personal financial information, it’s important that you do so carefully. Working with Farber Tax Solutions is the right option at this point. Our team of legal and ex-CRA professionals know how to talk to the CRA and resolve tax problems.

If you disagree with the CRA assessment, it is possible to object. This process is started by filing a Notice of Objection. In this objection, you will need to provide proof of your argument in the form of invoices, receipts, or other documents. The Farber Tax Solutions team can help you prepare your objection, giving you the best chance of having it accepted. Creating a strong case and backing it up with evidence is your best option at this point. Contact us today to find out how we can help.

Understanding a CRA Notice of Assessment

Much like with many government documents, especially those coming from the Canada Revenue Agency, the Notice of Assessment can be somewhat difficult to understand. CRA processes and documentation are often written in complex language and structured in a way that isn’t exactly “user friendly.” However, the details listed in a CRA Notice of Assessment are important, so it’s a good idea to learn what information is included and why this information is important.

A typical Notice of Assessment issued by the Canada Revenue Agency includes the following:

- Your contact information (Name, address, etc.)

- Your social insurance number (SIN)

- Statement date information (the tax year to which the assessment applies, the type of return to which the assessment applies, and the date that the statement was issued)

- Information on any actions that you need to take (this section will inform you of the details of the assessment, explain any changes that have been made by the CRA, tell you how much you have already paid in taxes for the tax year in question, and list if you are required to pay any additional taxes)

- A summary of your account (this will list your current year balance)

- Payment options (details on how you can pay, such as paying online or paying your taxes via your financial institution)

- Information on your RRSP and TFSA contribution space

What does a Notice of Assessment look like?

A CRA assessment is a document that lists many details. No matter how you receive your Notice of Assessment (either online or through the mail) it will contain the same information, though there may be slight formatting differences depending on how you view the document.

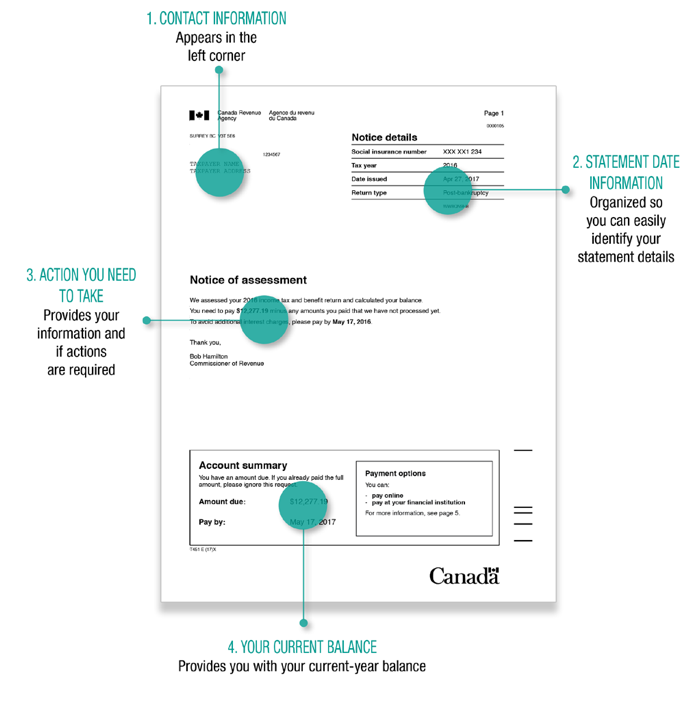

In general, your contact information will appear in the left corner, the statement information is in the right corner, the actions you need to take are listed near the middle of the document, and the account summary is detailed in a box at the bottom.

Notice of Assessment Sample

A Notice of Assessment sample is available on the CRA website and pictured below:

The CRA Assessment is an important document since it lists what actions you will need to take. This is critical as failure to cooperate with the CRA and failing to pay taxes that you owe can lead to significant consequences. For instance, if you owe a balance and do not pay it or make arrangements to pay, the agency can take significant collection action. The CRA is able to garnish wages, freeze bank accounts, seize assets, and take many other serious steps to collect a tax debt. Failing to pay attention to the Notice of Assessment will leave you unsure of how to proceed and that could potentially open you up to serious financial and potentially even legal issues.

If you disagree with the Notice of Assessment, you are able to formally object. However, there are time limits in place for doing so and these limits often relate to the date listed on the Notice of Assessment. This is another reason why you should read through your assessment when you receive it. Not only will you be able to determine if you agree with what is listed, but you will also need information from the assessment if you hope to object.

If you are planning on negotiating a payment plan or objecting to your assessment, you should have professionals on your side. Please contact us today for more information.

How to Get a Notice of Assessment

Most people will receive their CRA Assessment in the same manner that they filed their taxes. This means if you file a paper copy, you will receive a paper assessment. It’s important to note that this method of receiving the notice can be slow. This is especially true if you file your taxes by mail close to the income tax deadline. Before a Notice of Assessment is sent out, the CRA must conduct their initial review of your taxes. The time right around the tax deadline is often very busy, so you notice could be delayed.

On average, it takes about eight weeks or more to receive your assessment by mail, though it could take longer if the CRA is very busy.

Getting Your Notice of Assessment Online

As mentioned, you will receive your Notice of Assessment in the same manner that you submitted your taxes. Therefore, if you filed online, you will receive your Notice of Assessment online. In most cases, you will receive an online Notice of Assessment within two weeks of filing. However, much like with a paper return, this could take longer if you filed very close to the deadline and the CRA is busy.

There is also an option called an Express NOA. This is a situation where you can receive the official document through a secure CRA service. If you opt to receive an Express NOA, you could receive your assessment right in your tax filing software, right after the return has been received and processed.

This online document will provide you with a complete summary of your tax situation, an explanation of any changes that the CRA has made, and other information that would typically be included in any CRA Notice of Assessment.

Individuals who wish to use the Express NOA service, must:

- Be registered for the CRA My Account service

- Be registered for email notifications

- Use a NETFILE-certified tax software

After you file your return and receive a confirmation message, you will be asked to enter your CRA My Account information (login and password). Once this is done, you will receive an Express NOA in your tax-filing software.

If you are an authorized representative and wish to receive an Express NOA, you must:

- Be registered as an electronic filer

- Be registered in Represent a Client and have a RepID, GroupID or business number

- Be authorized for online access with the CRA

- Complete the necessary forms and returns then select the Express NOA option

- Use EFILE-certified software.

It is important to note that the Express NOA will not show any payments that you have made. If you file your return, make your payment, and receive your NOA all right after one another, your Assessment will be prepared too quickly to properly show any payments you have made. The CRA recommends that you check your bank account online or the CRA My Account section to confirm your account balance. You can also call the CRA’s automated account balance service.

No matter how you receive your NOA, it is important that you read the information in it and act appropriately.

How Long after Notice of Assessment do you get Refund?

As mentioned, there is sometimes a delay associated with receiving your Notice of Assessment. This is especially true if you filed your taxes close to the income tax filing deadline. During busy times, it will take longer to receive your assessment and therefore receive your refund.

In general, it takes between two and 16 weeks to receive a refund after you file your taxes. However, much like it takes longer for the CRA to mail out paper assessments after it receives a paper-filed return, it also takes longer to receive your refund if you choose to have a cheque mailed to you. According to the CRA, you can receive your refund more quickly if you choose to receive your refund via direct deposit.

You can check the status of your return or refund in several ways. Individuals can check the status of their returns, view their Notice of Assessment, modify their returns, make payments, and access other information on the CRA My Account page. You can also use the MyCRA mobile app to get similar information about your tax returns and your tax situation.

You can also get information on your return or your refund by calling the CRA’s Telefund line or the Tax Information Phone Service. If you wish to do this, you will need to ensure that you have certain information available. When you call, you will need to provide the following:

- Your Social Insurance Number (SIN) for a business number, as applicable

- Your name or business name, depending on your situation

- Your address or business address

- Your date of birth if you are calling as an individual

- Individuals who inquire will need to provide details from their account or a previously assessed return, notice of assessment, etc.

- Business callers will be asked to provide details from your account or your most recently assessed business return

It is worth noting that the CRA does not start processing returns until mid-February, no matter how early in the year they are filed. This means that you should not count on receiving your refund until at least March, even if you file in January.

There are a number of ways that your tax refund can be delayed. For instance, if your contact information has changed, the CRA will need to contact you to verify information about your return, which can slow the time it takes to process your return. This will cause your refund to be delayed as well. In addition, if the CRA finds errors in your return, or if your return was randomly selected for an audit, this will also lead to delays.

If the CRA contacts you regarding errors in your return or informs you that you have been selected for an audit, it is important that you proceed carefully. Working with experienced professionals is crucial. Making a misstep can significant and you want to ensure that you are handling the situation in the best possible manner. Please contact us to find out how our team can help you. We are here for you.

What You Need to Know About a CRA Notice of Assessment

As mentioned, a CRA Assessment is an important document. It provides you with critical details about your tax situation and informs you of the correct next steps to take. Tax situations can get very serious very quickly, so it’s important to pay attention to any and all documents that you receive from the CRA. Failing to read them properly and failing to act (if necessary) can result in a serious tax situation that can be quite difficult to deal with. While professionals can assist you in resolving your tax problem at this point, it is better to act properly initially and avoid any issues rather than make a mistake.

Your NOA doesn’t just contain information on how much you owe or what steps to take next. It also includes details on your Registered Retirement Savings Plan (RRSP) contribution limit for the year and your Tax-Free Savings Account (TFSA) limit. The assessment may also list details on your Home Buyers’ Plan (HBP) balance and repayment information. This is important information to have for financial planning purposes and it can help you prepare your tax return next year. This is why it is not just important to read your Notice of Assessment and take the time to understand it, but it’s also important to keep this document safe. You should keep a copy of your Notice of Assessment wherever you keep the rest of your tax paperwork. The CRA recommends keeping your tax records for at least six years from the tax year they apply.

It’s important to know that your assessment isn’t just needed for income tax purposes. If you apply for a mortgage or another type of loan, the financial institution may request that you provide them with a copy of your Notice of Assessment to prove your income. Some social programs may also ask you to prove your income via your NOA.

If you lose your Notice of Assessment, you should be able to view it on the CRA’s My Account page. You may have to sign up for this service if you have not done so already. Once you’ve signed up and logged into the service, you can find the information listed in your NOA online and download a copy of your assessment.

In addition to the next steps and the financial information provided on an NOA, you’ll also want to take note of the date on the assessment. The reason why is because this date is critical when it comes to objecting to your assessment. If you disagree with the information listed in the NOA, you are able to file a formal objection. However, there is a deadline for objecting, and this deadline is based on the date listed on the assessment. While it is possible to have the deadline extended, this option is only available in certain situations.

If you are considering objecting to your Notice of Assessment, it is best to have professional assistance when you do. Our team can help. Please contact us today for more information.

If You Disagree with your CRA Notice of Assessment

When you receive your Notice of Assessment, the CRA may have made changes to the numbers that you entered on your return. The agency uses the information it gathers from various sources to make these changes. If you agree with the information in the assessment, you should pay the balance owing (if there is one) and then move on. There is nothing more for you to do at this point. However, if you disagree with the Notice of Assessment, you are able to object. Everyone makes mistakes or interprets things differently, including the CRA. However, Canada’s tax system is based on self-reporting information. That means it is up to the taxpayer to object if they believe the CRA has made an error.

Filing a Notice of Objection

There is a formal process in place for objecting to a CRA assessment and it begins by filing a Notice of Objection.

As mentioned, there are time limits associated with filing a formal objection. For individuals, the Notice of Objection must be filed within 90 days after the date on the Notice of Assessment or Reassessment or one year from the filing deadline of the tax return, whichever date is later. This requirement is why it is so important to read your CRA assessment and take note of the date listed on it.

For instance, if you file your taxes at the end of April 2018 and receive your Notice of Assessment in May 2018, one year from the date of the filing deadline at the end of April 2019. This would be the deadline to file an objection since this date is later than 90 days from the date on the assessment.

You can potentially have this deadline extended, but you will be required to explain why you did not file by the original deadline, provide proof to back up your reasoning, and show that you filed as soon as you were able to. This can be difficult to prove and, therefore, it is recommended that you file by the deadline if possible.

When you file an objection, you will be required to explain which assessment or reassessment you are objecting to, what issues you believe to be present in the assessment or reassessment, and how you believe you should have been assessed. It is critical that you provide receipts, invoices, documents, and other evidence to support your claims. You will need to make sure that you explain your situation properly and that the evidence you provide is clear. This will increase the chances of your objection being accepted.

If the CRA does not agree with your objection, you can appeal the situation.

It is strongly recommended that you work with a professional when preparing your objection and it is even more important to have professionals on your side if you are filing an appeal. The team at Farber Tax Solutions can help you prepare your objection and communicate and negotiate with the CRA on your behalf. Our years of experience give you the best chance of a successful objection.

What is a “Notice of Reassessment”?

As mentioned, when you submit your tax return, the CRA conducts an initial assessment. This assessment is performed relatively quickly and primarily based on the information the CRA already has on hand. However, the agency could learn additional information later. If this happens, and if it is determined that this information changes your tax situation, the agency can issue a Notice of Reassessment.

The Notice of Reassessment will list much of the same information as the Notice of Assessment. It will explain where changes have been made to your return and explain what your next steps will be. Your options in responding to a CRA Reassessment are similar to a CRA Assessment. If you agree with the information in the reassessment, you should pay any balance owing and move on. Note that there could be significant interest charges associated with the tax owing, as the CRA is able to charge compound daily interest on the debt back to the date when it should have originally been paid. If you owe a large amount and if it has been quite some time since the return was due, you could be faced with a significant amount owing.

If you are not able to pay the tax owing in a single payment, the CRA may be willing to agree to a payment plan. If this is your situation, it is a good idea to work with a professional to negotiate with the agency.

If you disagree with the Notice of Reassessment, you are able to file an objection. Your Notice of Objection will be due 90 days after the date listed on the reassessment or one year from the filing deadline of the return, whichever is later. For instance, if you file your taxes at the end of April 2018 and your return is reassessed in March 2019, 90 days from this date is June 2019. That would be your deadline since it is later than one year from the initial filing deadline.

The CRA is able to reassess individual tax returns for three years after the date on the initial Notice of Assessment. However, if the CRA believes that the taxpayer purposely misrepresented themselves, made errors due to carelessness, or if the agency thinks that fraud has occurred, it is able to go back further. If this happens, it becomes even more critical to have a professional on your side, since the situation can get quite serious quite quickly.

Canadian tax law is often difficult to understand and CRA agents can be tough to communicate with effectively.

Dealing with the CRA is almost always a complicated and confusing affair. As mentioned, if you are planning on talking to the CRA to arrange a payment plan, or if you are considering filing an objection, you should speak with our team first. We have the experience and skill needed to communicate and negotiate with the CRA as well as the knowledge needed to file a successful objection. Contact us today. Our team is available and here to help.